初心者でもまるわかりFX外国為替チャートオンライントレードの専門サイトです。

http://wwww.fxforex.biz

FX real twitter news

FXプロトレーダー投資方法参考

Trade diary & soliloquyHEADLINE

Trade diary & soliloquy

- ~ April, 2012 May, 2012 June, 2012 July, 2012 August, 2012 September, 2012 October, 2012 November, 2012 December, 2012 January, 2013 February, 2013 March, 2013 April, 2013 May, 2013 June, 2013 July, 2013 August, 2013 September, 2013 October, 2013 November, 2013 December, 2013

-

- Buying of the Eurodollar is strengthened suddenly on December 31, 2012, and restore 1.32. The day's high is around 1.3235. Are the force that I seem to still achieve

-

- Eurodollar seems to be conscious of a support line around 1.3164 on December 31, 2012. When I buy it and go in a glance, may be interesting.

- The Hong Kong FX-M logic-limited exhibition was December 30, 2012 tomorrow at last until 24:00 of 31st. So that the hastens it. A year gets it, and sale end or large raised ♪ already remains, and the frame is with 9 person's names.

- 2The results of today's Hong Kong FX-M logic were +31 ten thousand Japanese yen on December 28, 2012. The trade of this year is end at some moderate level. The age that is good, everybody♪

Today's results: http://fxforex.biz/2012-12-29.html -

- Movement of the Japanese yen buying continues on December 28, 2012. As for dollar Japanese yen, as for the Euroyen, the 113.85 neighborhood, pound Japanese yen are cancellation in a fall, a rise share of the Tokyo morning at one time to the 128.60 neighborhood the 86.10 neighborhood. The European stock does not show small movement, the movement that the Europe bonds trend calms down, and is negative, but it is likely that profit-taking selling plays a key role in the exchange market because it is at the end of the year on the weekend. Because the trader whom I bought to here is easy to run about for profit-taking, the sudden drop is the situation that is easy to take place. Let's be careful.

- The results of today's Hong Kong FX-M logic were +55 ten thousand Japanese yen on December 27, 2012. Because a trend was plain, were comfortable today.

Assume it the end for moderation. Still, are . in dollar Japanese yen There

may not be resistance to stop as much as business is thin. Possibly the

country intervenes, too, and may move a money order for dollar buying yen

sale on the run taking the opportunity. Because if business is thin, can

move it for a low expense.

Today's results: http://fxforex.biz/2012-12-27.html -

- The Eurodollar seems to be still strong in a rise on December 27, 2012. Will the near future be the place where the resistance line per 1.3304 is passed through like a brick? In addition, is pound Japanese yen an upward trend again, too?

-

- Adjustment seems to begin movement of the weak yen on December 27, 2012. Increase to 85.60, and dollar Japanese yen has a short rest. Cross Japanese yen fails to rise in the whole, too, but there is the movement of the weak dollar including the rise of the Eurodollar, too, and the fall is minimal. Some advance becoming dull is seen. May be cautious of the new unemployment insurance application number tonight of America, consumers confidence index, the number of new home sale.

- Today is +76 ten thousand Japanese yen on December 26, 2012. Business made it thin, but were good, and were able to get on a flow because directionality was plain. The Hong Kong FX-M logicwas good at it to catch a trend, and the shin ♪-limited exhibition remained, and it was just with 36 people. So that the hastens it♪

Today's results: http://fxforex.biz/2012-12-26.html -

- Dollar Japanese yen still increases with the 85 yen 20 sen level well on December 26, 2012. It is cross Japanese yen to be stronger in a tendency to weak yen, and, as for the Euro yen, it is with a change in the 112 yen 40 sen neighborhood that is today's high price zone. Weak yen seems to be the flow of the factor not strong dollar. The euro is supported by an anti-circle, and the spread in prices rises against dollar although being small. May surpass the dollar Japanese yen 90 yen level as it is when a rise is strengthened. There is resistance around 86 yen, 94 yen 84 sen,; but of the business may exceed it at a stretch while is thin.

-

- Because market price is quiet, from ♪ Friday that is December 25, 2012 Mary Christmas to today, are a no trades. There seems in particular to be no it with this quiet market price in a chance because "the Hong Kong FX-M logic" is technique of the types to capture a trend.

- s today's eyeball rice) Univ. of Michigan consumers confidence index on December 21, 2012? Seem to work after this. The Eurodollar considerably raised pound Japanese yen, too, but because overprice is held down, pick quarrel on the weekend, and it seems to have possibilities to be with big fall pressure for the moment.

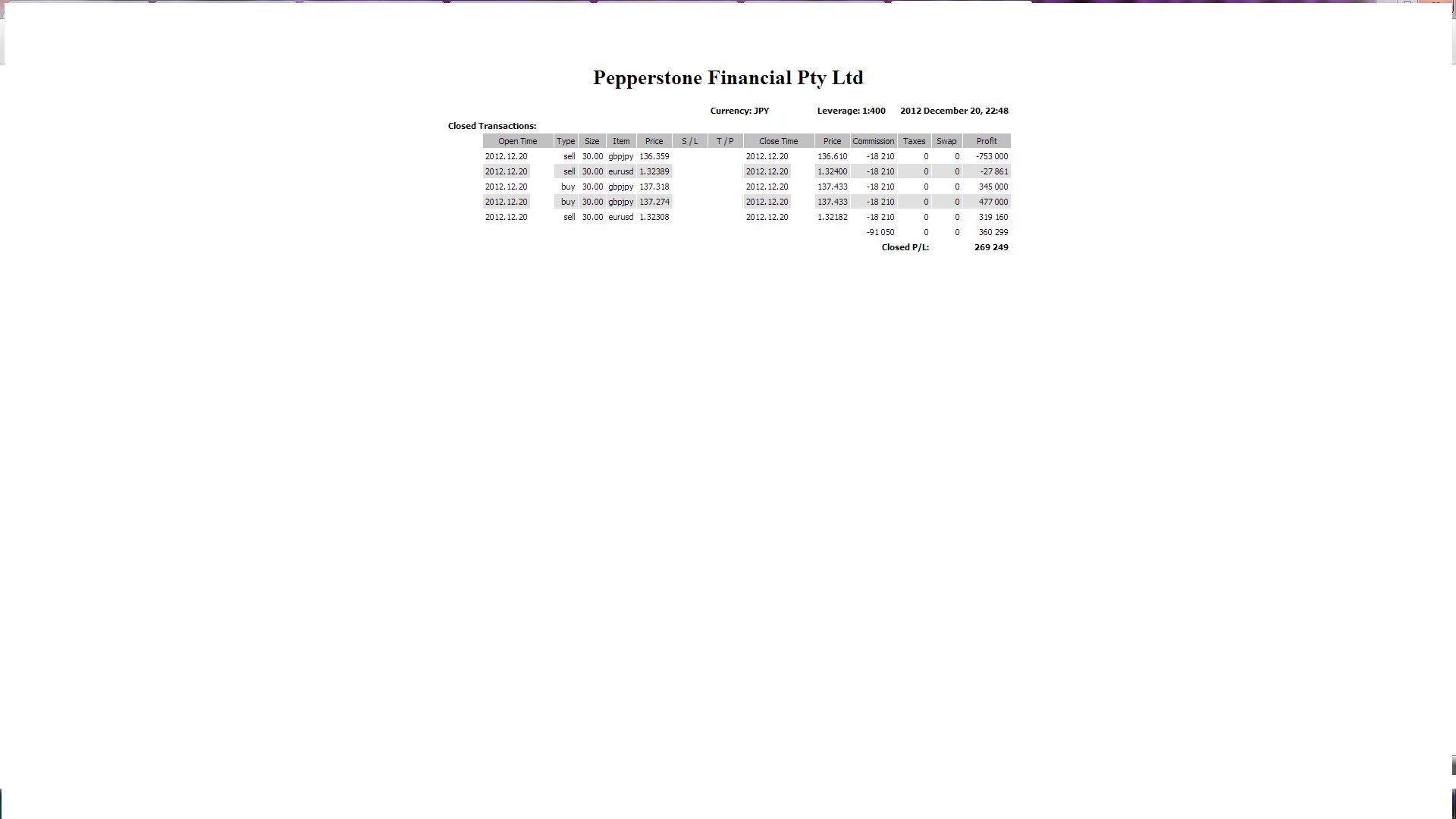

- Got crowded for a trendy follow logic exhibition a little on December 21, 2012, and update became slow. For 19 days, the results of 20th are streets of the images as follows. Remained in +260,000 yen and small profit on +60,000 yen, 20th on 19th. Were not able to get on the wave well. Because you show it tonight, please look forward to the one of the logic. In addition, will tell you later.

-

- Because were the logics of the trendy follow type that I talked about from before December 19, 2012, but had many requests,

Decided to show it with a limitation of a few.

If there is even a logic to be able to overcome, the FX trade is not precocious despite perfection.

Will be necessary for money management and men Tal.

But logic to be able to earn where I did it well.

Look at the business record from this diary recently↓

http://fxforex.biz/diary8.html

Were profit of 1,790,000 yen for 18 days.

Because start an offer with a limitation of the number of people at 10:00 on the night of this Friday,

Please wait for the person who wants to make living as FX trader in front of a PC♪

- Because were the logics of the trendy follow type that I talked about from before December 19, 2012, but had many requests,

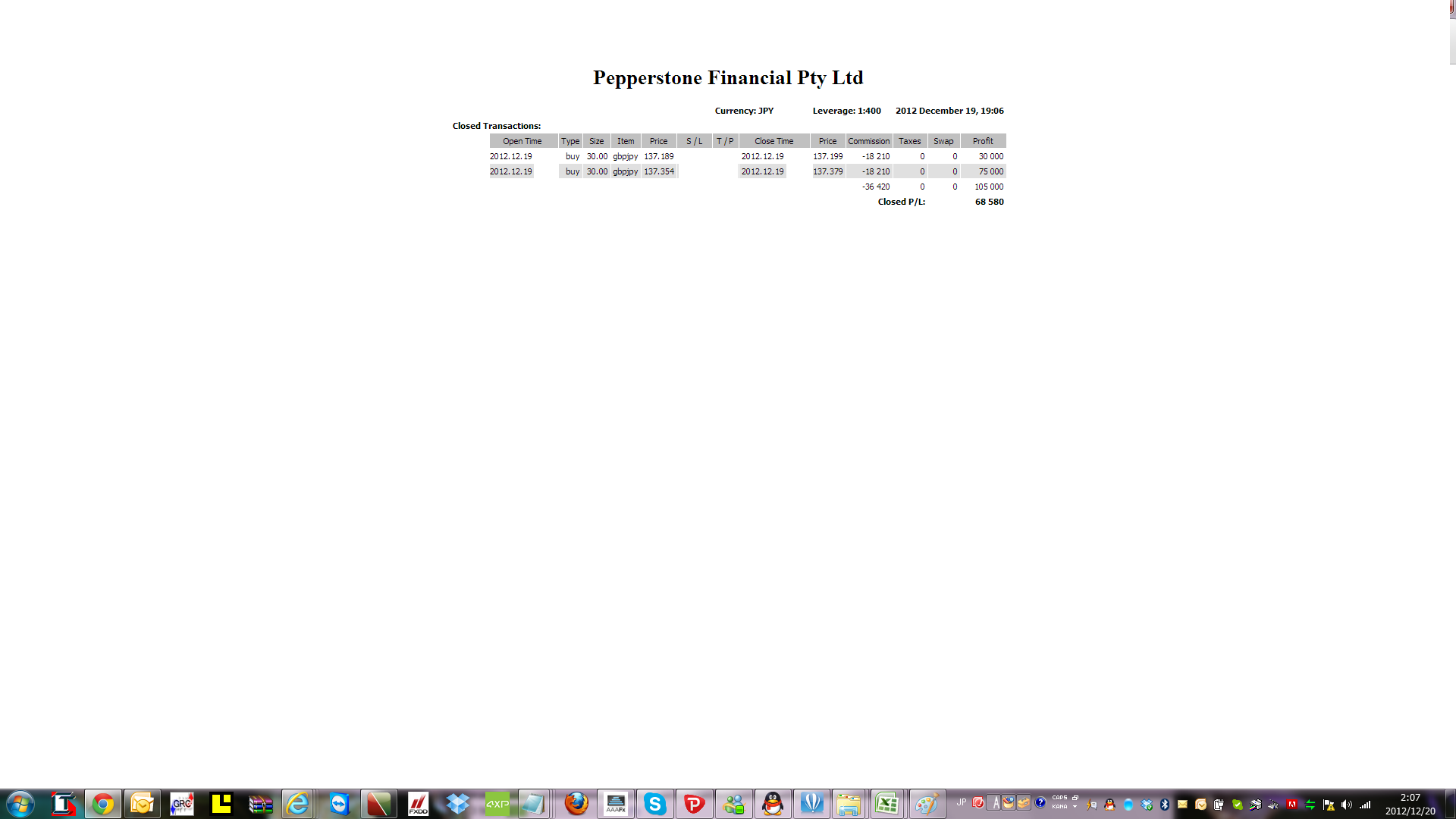

- By the way, the results of the yesterday's trendy follow logic were +179 ten thousand Japanese yen on December 19, 2012. The elation trade that clears itself from pent-up anger from weekend to Monday. After all, as for the logic to capture a trend, what can start big profit by 1 trade if the points to catch well are caught is attractive. Are going to show only a few now only in amount-limited, a period this Friday. Will tell you about the details tomorrow.

-

- Pound Japanese yen already raised it on December 19, 2012. Seem to rise sequentially. Today's attention where free of charge, 18:00 Germany) IFO state of things index, 18:30 Are British) BOE minutes publication, 22:30 Housing Starts, the construction permission number. Work, or let's pay attention to which with an individual index.

-

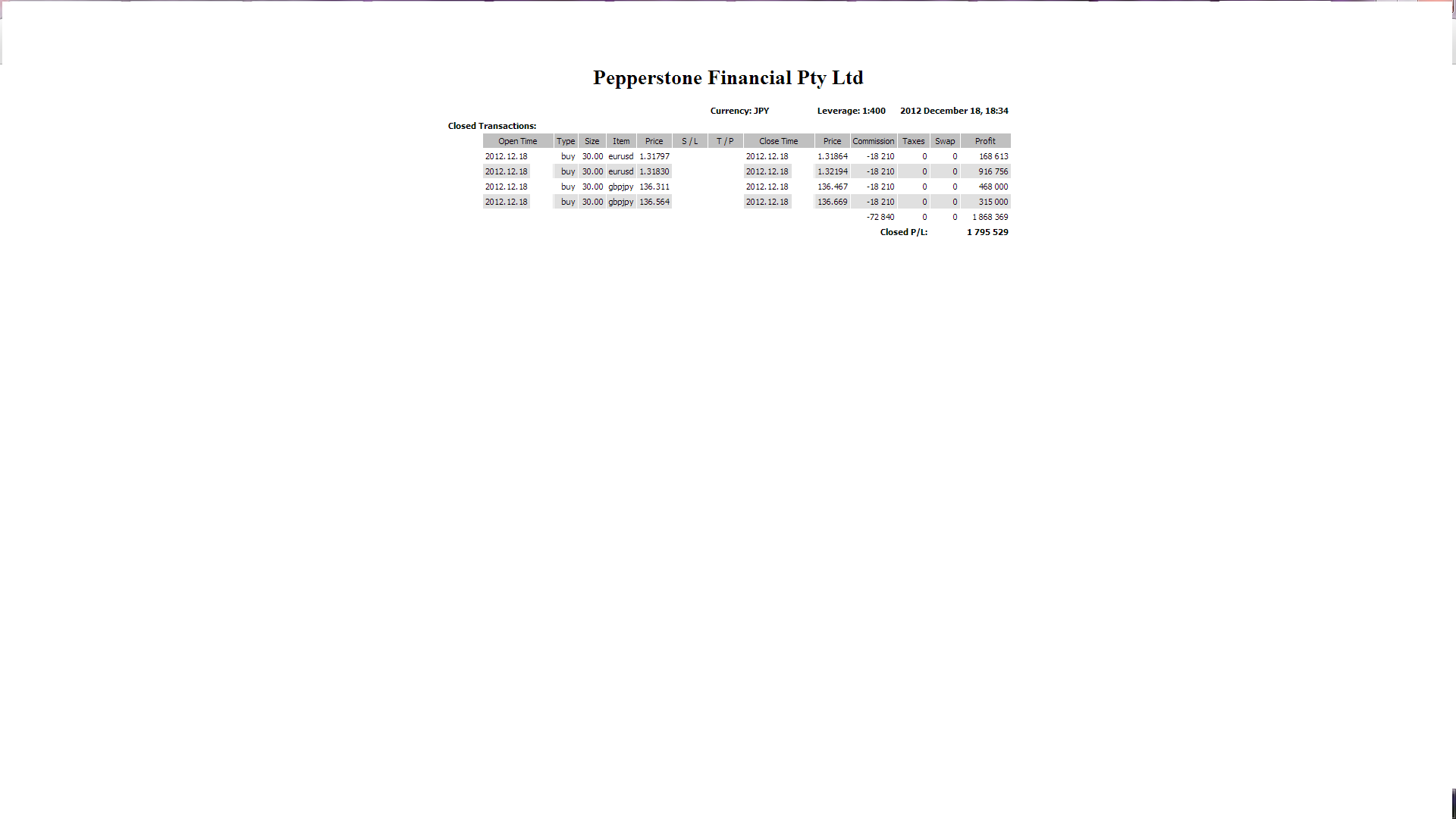

- The December 18, 2012 fruit is a current trendy logic, but are near, and think about a thing showing with a limitation of the number of people because several people have you try it, and they are readily popular toward the monitor now. Contact me later again if it becomes near.

- Are ク results of yesterday's on December 18, 2012. -Were 150,000 yen.http://fxforex.biz/2012-12-17.html

-

- December 18, 2012 euro dollar buying pressure is strong. Should attack it by buying.

-

- Friday, December 17, 2012 is, a no trade. The trend that appeared at around 25:00 was delicious, but already slept.

- Are the yesterday's results on December 14, 2012. Were hard to enter. Approximately +460,000 yen.

- Are the yesterday's results on December 13, 2012. The last trade was unnecessary. Have done an entry without watching a flow of the market price that the concentration became loose, and was general after a meal. Are reflection. But, as for the quota of 500,000 yen a day, the neighborhood settles because I was accomplished. Want to profit constantly.

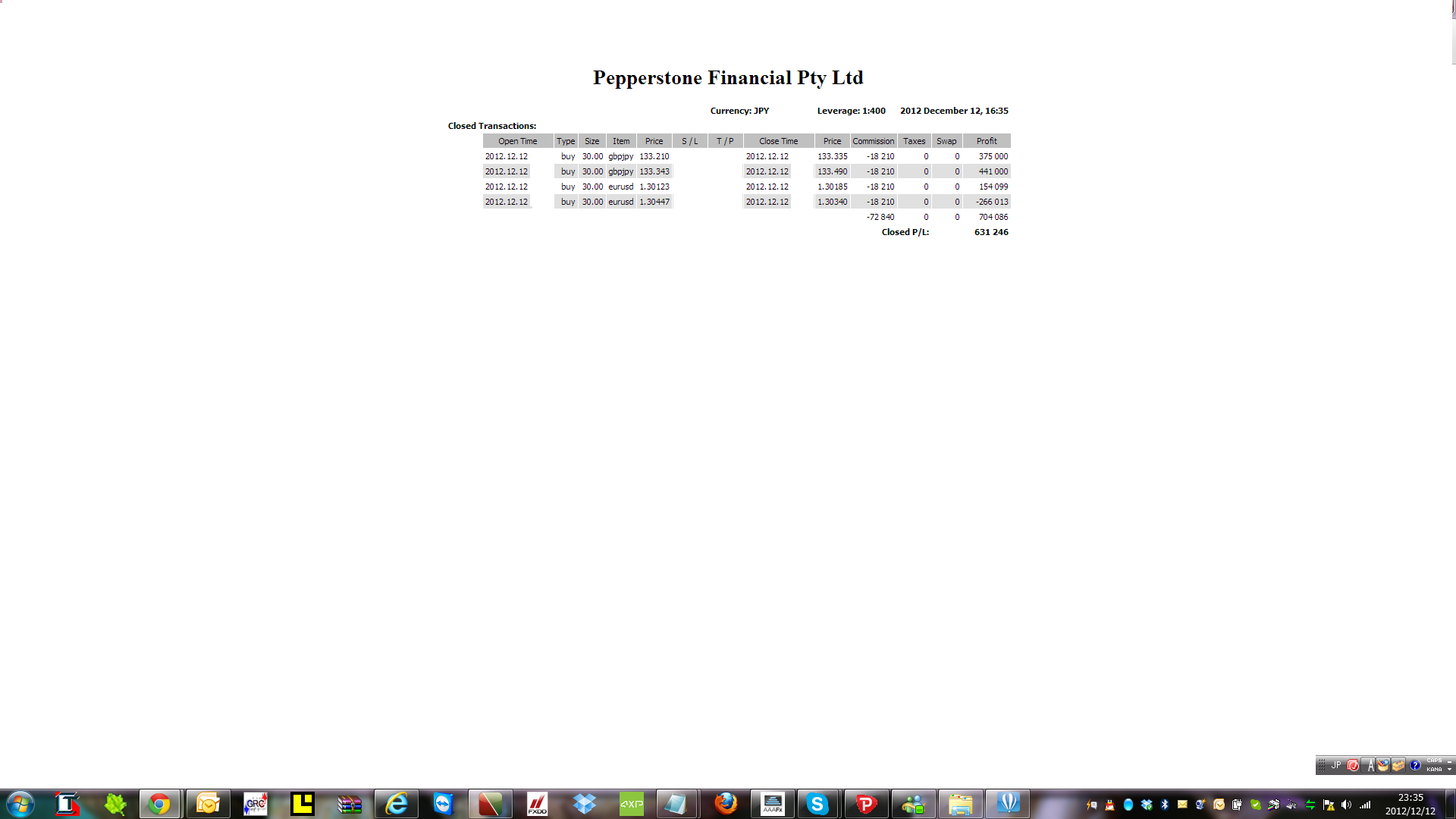

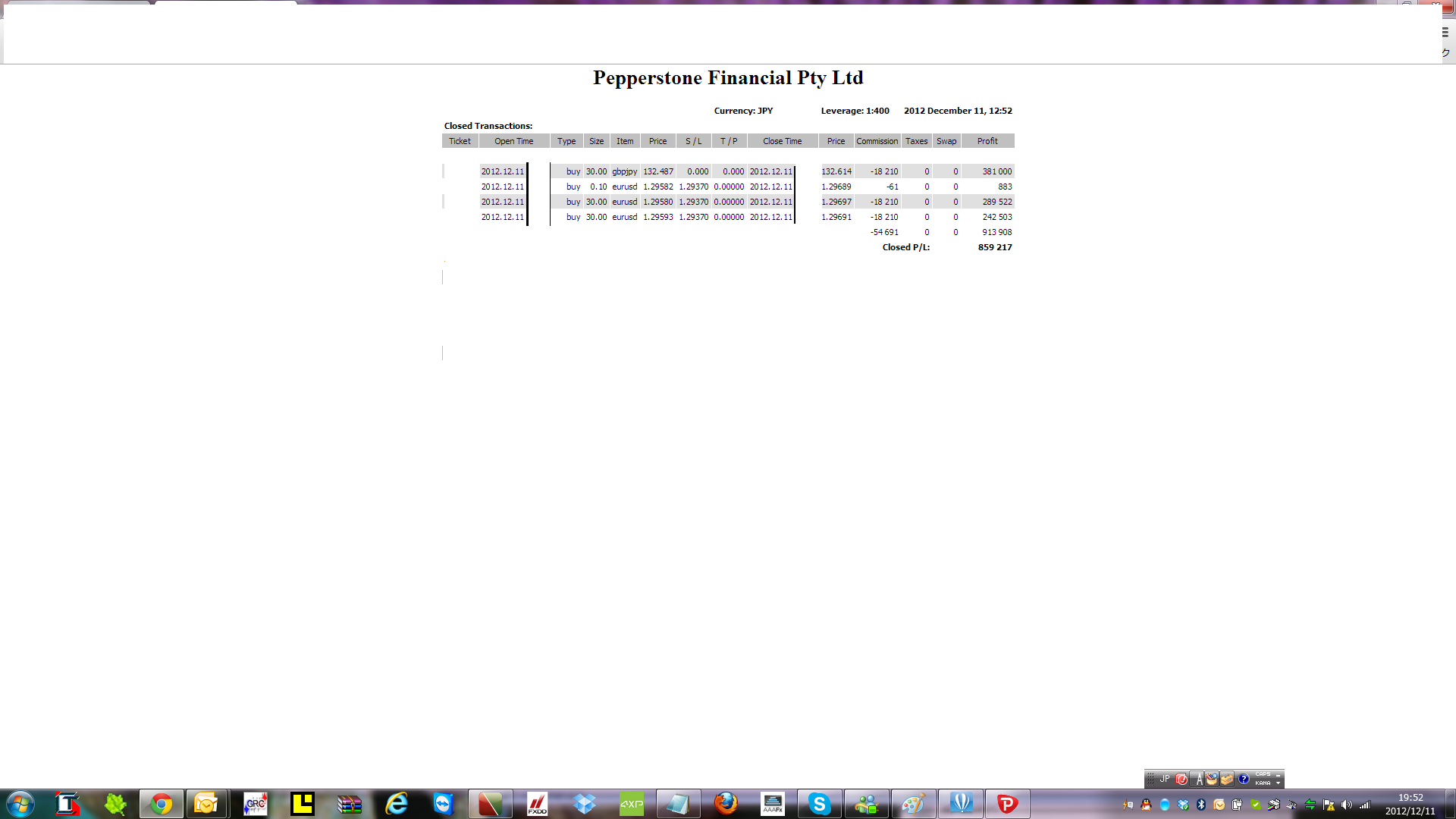

- 2Are the results of the trendy follow type logic that I talked about yesterday on December 12, 2012. Were the speculation that it was easy to read of the flow for the short-tempered trade. The second trade inputs lot, and make a mistake, and become the form that I made a re-entry immediately afterwards. Except a Miss entry, were profit approximately +859,000 yen by 3 trades.

-

- Put up Eurodollar on December 10, 2012. Share, a support seem to work where you return it to.

-

- Eurodollar lowers it like a brick to here on December 10, 2012, and become quiet by a struggle now, but show a rise in inversion as support in a 1.2870 area from here, and are horns, or are attention whether you continue falling down as it is.

-

- We have announcement of the number of the American employment statistics, nonagricultural sector employers at 22:30 today on December 6, 2012. The active trade will wait before this♪

-

- Settled 3 positions of the Eurodollar in 1.3033 some time ago on December 6, 2012. Were +65 pips♪

-

- Make Eurodollar Martin-style averaging not loss cut this time on December 5, 2012. The lot was suppressed, but accepted 2 position selling in 1.3087 some time ago. Are 3 positions in total for the moment. Furthermore, examine another 2-3 times sell if I get nervous.

-

- The European stock market of the middle stage fails to rise a little on December 4, 2012. Lower the anteroom, and began, but change it immediately, and rise. It follows it that Greece and one Spanish weight disappeared although I receive the fall of the U.S. stock last night, and selling led and is favored. But lack in materials buying positively, and the overprice is restrictive. The movement of the exchange may be restrictive, too.

バナースペース

トレードの実績

2013年01月 +317万円

2013年02月 +457万円

2013年03月 +1,302万円

2013年04月 +1,385万円

2013年05月 +895万円

2013年06月 +1,168万円

2013年07月 +1,040万円

2013年08月 +1,156万円

2013年09月 +955万円

2013年10月 +670万円

2013年11月 +671万円

2013年12月 +474万円

2013年合計:+10,450万円

2014年01月 +1,217万円

2014年02月 +517万円

2014年03月 +600万円

2014年04月 +554万円

2014年05月 +697万円

2014年06月 +343万円

2014年07月 +762万円

2014年08月 +168万円

2014年09月 +316万円

2014年10月 +699万円

2014年11月 +639万円

2014年12月 +332万円

2014年合計 +6,760万円

2015年01月 +597万円

2015年02月 +788万円

2015年03月 +524万円

2015年04月 +679万円

2015年05月 +558万円

2015年06月 +1,303万円

2015年07月 +1,088万円

2015年08月 +1,205万円

2015年09月 +1,104万円

2015年10月 +2,694万円

2015年11月 +522万円

2015年12月 +1,422万円

2015年合計 +12,574万円

2016年01月 +1,352万円

2016年02月 +1,845万円

2016年03月 +1,414万円

2016年04月 +1,877万円

2016年05月 +1,476万円

2016年06月 +1,571万円

2016年07月 +1,573万円

2016年08月 +925万円

2016年09月 +1,802万円

2016年10月 +832万円

2016年11月 +475万円

2016年12月 +1,616万円

2016年合計 +17,026万円

2017年01月 +766万円

2017年02月 +628万円

2017年03月 +1,050万円

2017年04月 +574万円

2017年05月 +1,207万円

2017年06月 +1,563万円

2017年07月 +753万円

2017年08月 +463万円

2017年09月 +44万円

2017年10月 +584万円

2017年11月 +545万円

2017年12月 +360万円

2017年合計 +8,484万円

2018年01月 +1,220万円

2018年02月 +497万円

2018年03月 +764万円

2018年04月 +1,139万円

2018年05月 +639万円

2018年06月 +1,361万円

2018年07月 +598万円

2018年08月 +1,327万円

2018年09月 +736万円

2018年10月 +761万円

2018年11月 +987万円

2018年12月 +372万円

2018年合計 +11,294万円

2019年01月 +569万円

2019年02月 +672万円

2019年03月 +649万円

2019年04月 +422万円

2019年05月 +874万円

2019年06月 +1,937万円

2019年07月 +1,275万円

2019年08月 −391万円

2019年09月 +711万円

2019年10月 +981万円

2019年11月 +886万円

2019年12月 +1,375万円

2019年合計 +9,639万円

2020年1月 +695万円

2020年2月 +33万円

2020年3月 +3,816万円

2020年4月 +1,247万円

2020年5月 +478万円

2020年6月 +2,007万円

2020年7月 +328万円

2020年8月 +1,636万円

2020年9月 +1,437万円

2020年10月 +733万円

2020年11月 -1,212万円

2020年12月 +912万円

2020年合計 +12,065万円

2021年1月 +891万円

2021年2月 +190万円

2021年3月 +1,687万円

2021年4月 +673万円

2021年5月 +767万円

2021年6月 +50万円

2021年7月 -806万円

2021年8月 +1,728万円

2021年9月 +622万円

2021年10月 -1,954万円

2021年11月 +598万円

2021年12月 +1,505万円

2021年合計 +5,917万円

2022年1月 -591万円

2022年2月 +2,103万円

2022年3月 +1,879万円

2022年4月 +4,073万円

2022年5月 +1,169万円

2022年6月 +4,678万円

2022年7月 +122万円

2022年8月 +2,366万円

2022年合計 +15,793万円

おすすめFX手法

・年利12,000%驚きのトレード手法

・カルロスのFXロジック

経済指標・用語

・相場用語

カルロス上杉の取引FX口座

FX口座の開設をお考えの方↓

まずは無料で、リアルタイム配信中

初心者でもわかるFX外国為替チャートオンライントレードの真実

E-Mail. info☆fxforex.biz

(☆を@へ変更ご連絡下さい。)